Point for the Multi Family Office (MFO)

Multi Family Offices (MFOs) manage the wealth and investments of multiple families, each with unique and complex needs.

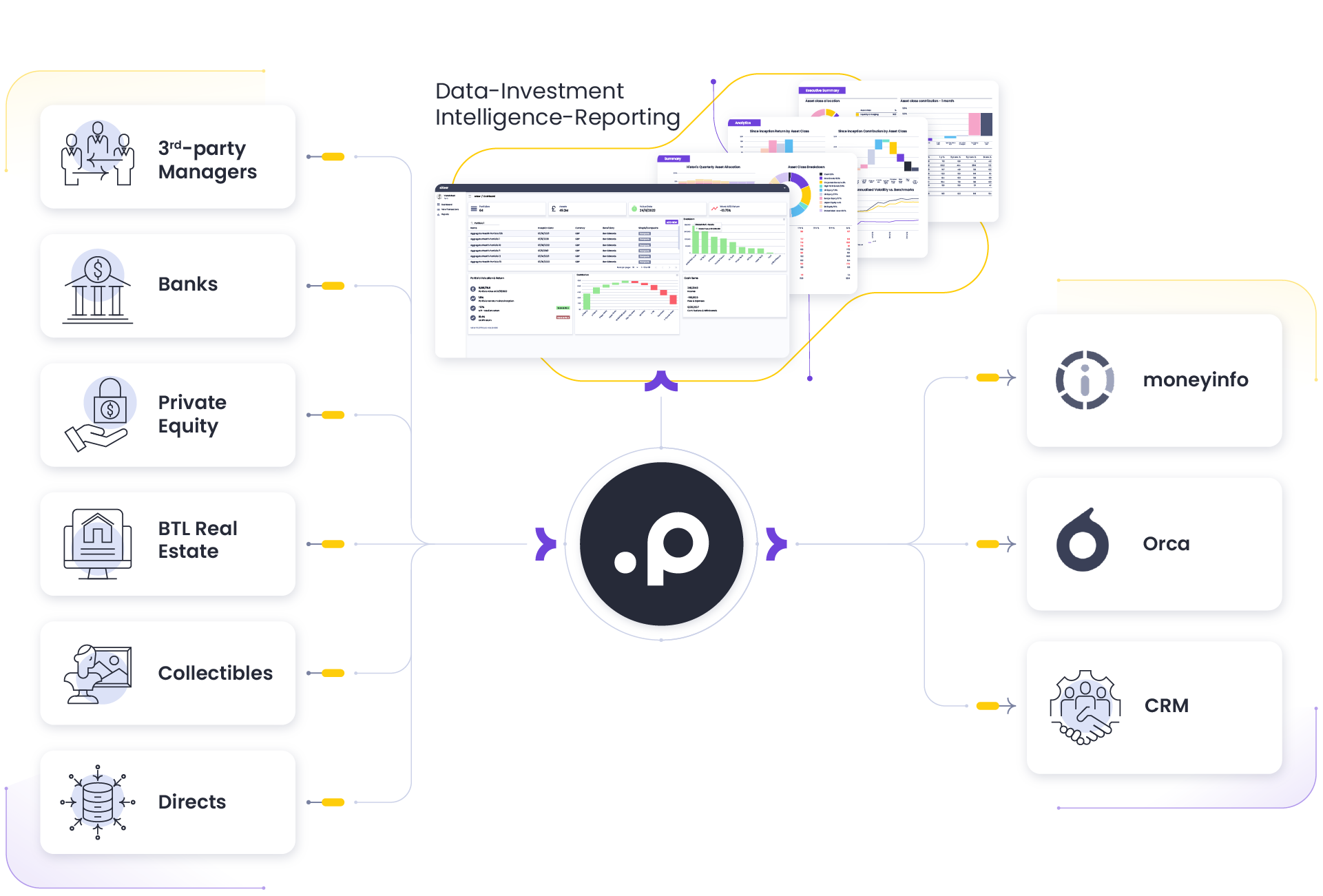

The Point Investment Data Intelligence platform addresses these challenges by providing a scalable solution that enhances data accuracy, streamlines operations, and supports informed decision-making across diverse portfolios.

Greater than the sum of their parts – the MFO integration opportunity:

MFOs must deliver highly personalised, high-touch services to their clients. Their advice must be accurate, detailed and ahead of the competition.

Deploy the Point platform as your investment data foundation, alongside ORCA’s market-leading governance and administration platform; moneyinfo’s best-in-class client app and portal; and your CRM of choice to build a scalable data-first trusted advisory business.

Benefits for Multi Family Offices

Unified Data Management

Build, maintain and secure the Independent IBOR on behalf of your clients regardless of custodian, manager or asset class.

Enhanced Decision-Making

Utilise advanced analytics to generate actionable insights tailored to each family's investment strategy.

Operational Efficiency

Automate manual processes to reduce errors and improve resource allocation.

Scalable Solutions

Break the link between increased client numbers and operating costs, whilst providing deep insights across your clients’ total wealth.

Improved Client Reporting

Generate accurate, timely, and customised reports for each client, enhancing transparency and trust.