Point for Discretionary Managers

Discretionary Managers are responsible for managing client portfolios with full discretion over investment decisions.

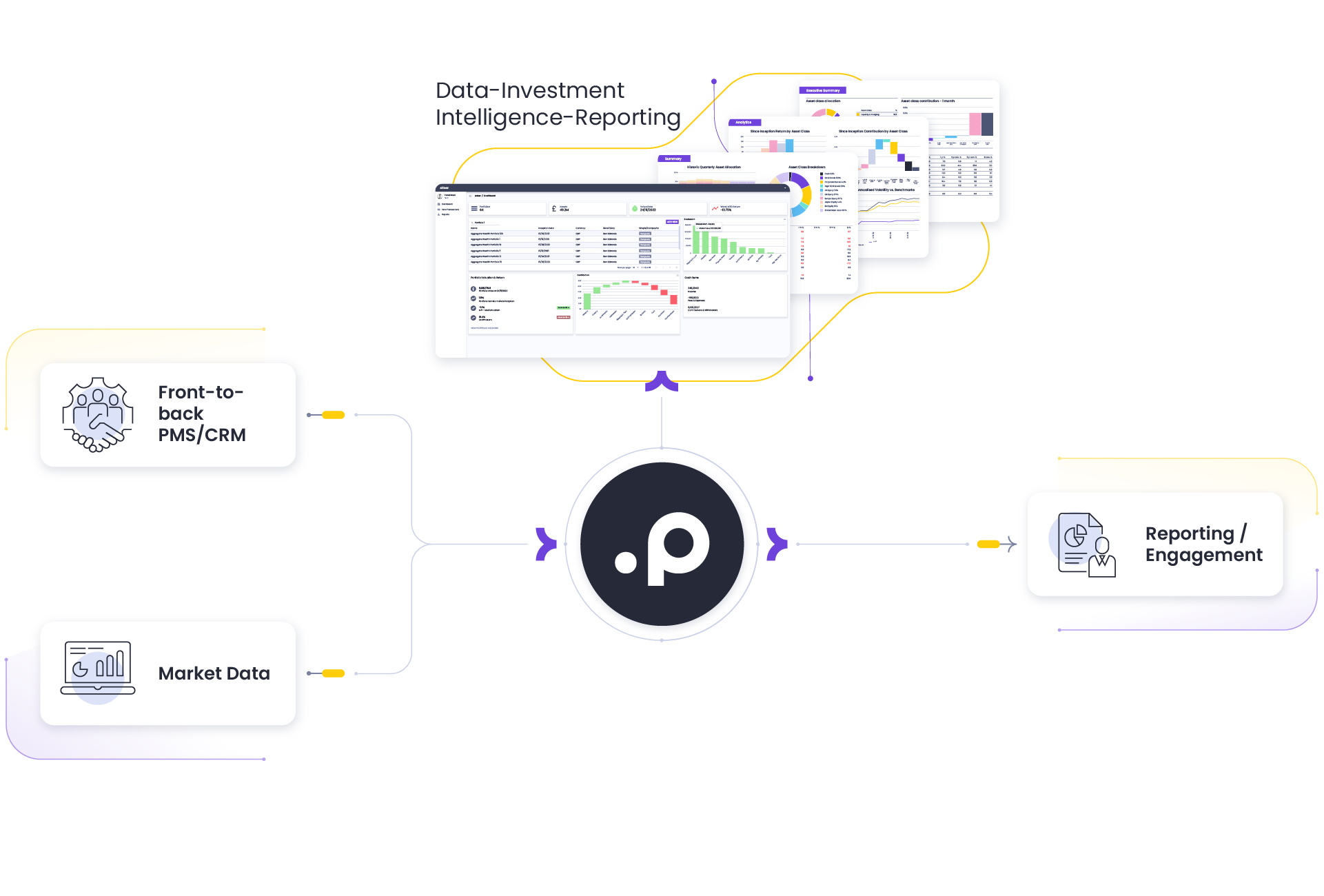

Point’s Investment Data Intelligence platform provides a comprehensive solution that enhances data accuracy, streamlines operations, and supports informed decision-making, enabling discretionary managers to optimize portfolio performance and client reporting.

Main Benefits for Discretionary Managers

Flexible Data Management

Aggregate data from multiple external (custodians, platforms etc) and internal (existing systems) into a single, interrogatable data platform.

Enhanced Decision-Making

Access accurate, timely, and analysed data that supports informed intelligence-led decision-making.

Operational Efficiency

Automate routine tasks and streamline data processes to reduce operational risks and free up valuable resources

Scalability

Adapt to the growing needs of an expanding client base and growing AUM/AUA with a flexible and economically scalable platform.

Improved Client Reporting

Generate accurate and timely reports that enhance transparency and client satisfaction.

Customised Operating Model

Build the operating model that suits your business when you need it, by integrating best-in-class solutions (CRM, onboarding, digital apps, finance etc).

Overcoming Data Silos in Discretionary Management

Traditional discretionary portfolio management solutions prioritise operational workflows and are commonly restrictive in how they treat and handle data. To provide the data flexibility required, managers frequently deploy manual workarounds and the ever-present excel spreadsheet to deliver the analysis and the reporting capabilities required. This approach is unscalable, imposes restrictions on the business and limits opportunities. To successfully compete in an increasingly demanding environment, managers must build data-first operating models, that place decision-making and client engagement front and centre.

Solution

Point’s Investment Data Intelligence platform focuses on providing discretionary managers the data flexibility they need.

The platform can be deployed either alongside existing traditional PMS solutions or independently, providing users with an accurate, unified data source from which to drive insights, engage clients and support the delivery of new products to the market.

It automates routine tasks, reducing manual errors and allowing discretionary managers to focus on the two key areas of competitive advantage: portfolio management and client relationship management armed with the actionable intelligence required to deliver excellence.